Another week. Another set of great reading news links. Here’s a sneak preview:

- Why Diversification Results In Mediocrity

- 7 Reasons Why Housing Isn’t Bottoming Yet

- Earnings back to 1922 (Chart).

- PIMCO says buy US Treasuries!!

- A sanity check for bulls: What is your forecast for the following a year from now?

Tax rate, including state, local, property and sales taxes (Up, down or flat)

Short term interest rates (Up, down or flat)

Employment (Up, down or flat)

Savings rate, remember the new frugality (Up, down or flat)

Consumer confidence (Up, down or flat)

Do your answers add up to a bullish outlook for the economy? I didn’t think so. - Dow Theory calls a bull market: The long-awaited Dow Theory bull market signal finally arrived yesterday. This came about as a result of the Dow Jones Industrial Average and the Dow Jones Transportation Average both breaking through their previous rally peaks (registered on 12 and 11 June respectively).

- Predicting how high S&P500 can go (Video)

- The recession isn't over... We're in the early stages of a depression! (Video)

- The Next Big Technical Pattern : This is not meant to be a short-term forecast but rather a framework for the bigger picture. As the S&P 500 trades toward its supposed neckline in the low 960s, I expect that more people will embrace another technical pattern that is really not there. A move above that level could have a similar, but opposite effect, and instead of creating a short squeeze it would create what a colleague has termed a "long squeeze."

When too many people think the same way, bad things happen. - Investor Sentiment: Investors Not Buying It : As investors are not buying into the rally, one might conclude that the rally will march onward and upward until they do, and then it will rollover. That seems likely. However, it is hard to imagine that prices will continue making gains at the pace seen over the past two weeks. I still stand by the sell signal and expected spike in prices that I wrote about two weeks ago. The recent "breakout" in prices will eventually be seen as a better time to sell rather then a new launching pad for a bull market. That's how I see it for now.

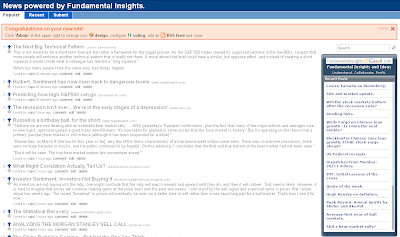

For much much more, please visit http://news.fundamentalinsights.slinkset.com/ or click the image below.