So I twittered this message yesterday end of the day:

Watch out! Looks like next week will decide how the month shapes up. Looks bullish. #MKT http://bit.ly/gnuC0

I was basically looking at this chart courtesy Bespoke :

Well, we finished up yesterday. I thought it would be interesting to see what the average performance would look like over the next week, and next month, if over the next day the markets were up. I took the subset and here’s what I got:

4 out of 5 times, the markets ended up higher over the next week and next month . Even if you exclude the extreme outliers, or take the median, the conclusion is still bullish. (Small data sample setups like these are always suspect. But this does tend to agree nicely with a "rally till July" which I suspect is how events might be unfolding. )

PS: I had actually written this up last night but somehow missed posting it.

Friday, May 29, 2009

A bullish setup.

Thursday, May 28, 2009

Google in Dow: are you kidding me? A look at possible replacements.

It’s almost a foregone conclusion that General Motors (GM) is going to be replaced from the Dow. People have started speculating on possible replacements:

From Yahoo Finance:

In a research note last month, Nicholas Colas, chief market strategist for BNY ConvergEx Group, laid out seven possible replacements for GM: bankers Goldman Sachs Group Inc.(GS) and Wells Fargo & Co.(WFC); high-tech firms Cisco Systems Inc.(CSCO), Apple Inc.(AAPL), Google Inc.(GOOG) and Oracle Corp.(ORCL); and agricultural products maker Monsanto Co.(MON).

Based on the market moving impact of high price stocks on the Dow index, I would safely rule out Google, and even Goldman Sachs and Apple would be pushing the envelope. Why? If Google were to be added at the current price, it would comprise 28% of the Dow index! Thus Google CANNOT possibly be a serious candidate for the price weighted Dow. With close to 10%, the biggest weight in the Dow currently is IBM. Even Apple or Goldman Sachs would contribute close to 11% and 12% respectively to the index, which is why I think their addition to the index is unlikely.

If that’s not reason enough, here’s another fact: What's the number of current Dow components not paying a dividend? Answer: ZERO. If this were to hold true going forward, that would rule out Google, Apple and even Cisco from the list of contenders. (Now, I know Cisco CEO John Chambers has promised a dividend before he quits, but that’s not happened yet.)

So assuming the analyst got the initial list of candidates right, there are only three possibilities in my opinion: Oracle, Monsanto and Wells Fargo.

I did some further reading and pulled together a list of additional replacement candidates from various commentators:

- WSJ’s Marketbeat suggests Deere (DE), Toyota Motor(TM), and British Petroleum (BP).

- Felix Salmon adds Amgen(AMGN) and Nike (NKE) to the list.

- CNN Money suggests Pepsi(PEP), Conoco Philips(COP) and Schlumberger(SLB) as additional names.

- Fox Business quoting Wall Street analyst Matthew Hougan adds Philip Morris (PM).

- This Reuters article further suggests Aetna(AET), FORD (F), Nucor(NUE) and Travelers(TRV).

- This CNBC article suggests, in addition to the names listed above, Amazon (AMZN) and Abbott Labs(ABT)

After the removal of Honeywell(HON) and Altria(MO) from the Dow, here’s what the committee had said:

On CVX addition: "As usual when we make any change we review all the stocks. In doing so, we saw that the financials industry was under-represented -- notwithstanding the current turbulence -- and that the oil and gas industry's growing importance to the world economy called for another representative to join ExxonMobil Corp.

On Honeywell removal: “Honeywell is being removed because it's the smallest of the industrials in terms of revenue and earnings. Additionally, the role of industrial companies relative to the overall stock market has been shrinking in recent years.”

At that time, Honeywell had net income of approx. $2.5 Billion, and revenues of ~ $35 Billion.

With Oil down to less than half from the peak, it seems unlikely that the committee would add another oil major, which makes me want to rule out COP, SLB and BP. Further, because of their emphasis on revenues and earnings, I would rule out Amgen, Abbott Labs, Nike, Nucor, Amazon and Aetna.

After adding AIG and BAC in the last 10 years and watching them lose most of their stock value, I’m not too sure how enthusiastic the board will be about adding another financial to the list, except perhaps to replace an outgoing financial.

This would leave: Oracle, Pepsi, Deere, Monsanto, Wells Fargo and Philip Morris as the serious candidates. PM and PEP sound like safe bets in this uncertain environment. Monsanto would be an interesting name given that agriculture could be a big growth industry going forward. One interesting pair which hasn’t been discussed are the drugstore chains, CVS and Walgreens. The Dow is underweight financials and health care compared to the S&P 500, so we could always see a name from those sectors.

If I were to make a guess, CVS/Walgreens, Oracle, Pepsi, Monsanto, Wells Fargo and Philip Morris would be my replacement picks. While I might be wrong on some of my conjectures, what seems certain is that the new Dow entrant is definitely not going to be Google.

Time will tell. Stay tuned! Read the rest of this entry >>

Tuesday, May 26, 2009

Festival Of Stocks #142

Fundamental Insights is excited to host the 142nd edition of the Festival of Stocks. Surveying the blogosphere for the best articles on investing and stocks, this weekly blog carnival highlights the best submissions of the past one week. If a submission was not closely related to investing in stocks it was excluded. Click here to find out more about this festival.

If this is your first time on Fundamental Insights, please feel free to explore this blog. You can read the favorite posts section, review the news section, follow Fundamental Insights on Twitter, or subscribe to this blog's feed.

Stocks

The DIV-Net website has a very nice review of Bristol-Myers Squibb(BMY) as a possible acquisition target.

Dividend’s Value reviews Illinois Tool Works Inc (ITW)

One Family’s Blog does a stock analysis on Ebay(EBAY) with a good discussion on PayPal

Stock pursuit points out that cheap micro cap oil stock HKN Inc. (HKN) is doing a stock buyback.

Investing

Old School news has some insightful reflections on stock market investing.

I take a detailed look at the Dow index, discussing the decreased importance of several low priced stocks in the price weighted index.

Magic diligence on the importance of stock selection in an out of favor sector. "While buying into a sold-off sector is good strategy, buying only the very best players in that sold-off sector is an even better one."

"You cannot simply decide if a company is a good buy or not just by looking at its price." Moolanomy.com on the dangers of penny stock investing for individual investors.

The SmarterWallet on developing an investment plan.

Trading

Jeflin suggests taking some profits. He argues that the bears might reassert their presence soon.

Sir Forex reviews the moving average convergence divergence( MACD) technical signal.

Forex and Currencies Explained has a primer on forex scalping.

Does CNBC know what a bid and ask are? You decide after reading this, courtesy the Political and Financial Markets Commentator blog.

Macro News

Harley-Davidson is up 140%+, Winnebago:170%+. Does that mean the recession is over? Mark Perry asks this question.

Reviving animal spirits is a necessary condition to reviving economic growth. Talk Money Blog discusses the role of confidence in recovering from a recession.

Firefinance points out that the current headline inflation numbers have been negative.

Reviews

Book review: Dividend Growth Investor reviews Dave Van Knapp’s book “The Top 40 Dividend Stocks for 2009”. It would be interesting to get the names for these 40 stocks!

Brokerage reviews: The Money Blue Book Blog reviews TradeKing, Silicon Valley Blogger does the same with Etrade, and CashMoneylife discusses some parameters to use while evaluating online brokerage firms.

Morningstar: Investing school compares the free versus paid memberships at Morningstar.

That concludes this edition of the Festival of Stocks. Submit your blog article to the next edition of festival of stocks using the carnival submission form. Past posts and future hosts can be found on the Festival of Stocks home page.

Sunday, May 24, 2009

Bullish market news? TSMC cancels earlier layoffs:

From Digitimes:

Taiwan Semiconductor Manufacturing Company (TSMC) has asked all laid-off employees to return to work to make amends for what company chairman Morris Chang describes as "regrettable actions" to dismiss them amid the economic downturn.

In an internal message, Chang expressed regret that when laying off those employees the company failed to show them appropriate respect or fully consider the difficulty for them to find new jobs in the bad economic times, according to the company.

Chang said that on May 13 company vice president YP Chin already extended an invitation to all the former employees to return to work beginning on June 1.

(You can also see this WSJ article)

Hmm.. I wonder if the end user demand is a lot stronger than is currently expected?

Background: Some of the biggest fables chip vendors are TSMC customers. I consider TSMC and other pure play foundries (SMIC UMC etc) to be an early leading indicator in the semiconductor space. The semiconductor industry itself is considered to be an early cyclical. This sector can be considered an early leading indicator of the end user demand.

How is that? Let’s take the handset sector for example. When handset vendors anticipate demand in their channel, they have to order the chips from the chip vendors a few months in advance. These chip companies are mostly fabless. They essentially have a “blueprint” for a chip which needs to get fabricated someplace in Asia, mostly Taiwan. The round trip time to when the chip companies have the actual chips in hand can be a few months.

So the number of companies rushing to have their “blueprints” being converted to actual chips can give us a good idea of the chip sector demand, which is an early reflection of the “anticipated” consumer demand. Back in mid February, reports started surfacing that chip foundries in Asia were cutting back or cancelling unpaid time off. That was a good early indicator that end user demand was coming back. Till then, TSMC had asked it’s employees to take compulsory unpaid time off. This was cancelled and the employees were ordered back. Now even the laid off employees are being reinstated!

Around March 10th, TSMC raised guidance and reported a surge of rush orders. That coincided almost perfectly with the “generational” low in March.

If TSMC has cancelled the layoffs it announced at the beginning of this downturn, that’s definitely good news for the global economy. I won’t be surprised to hear some surprisingly good economic numbers in the next month or two(Expect the “worst is over” crowd to reach a crescendo). Further, the 50day-200 day moving average crossover I reported in early April on the Shanghai index is a very solid bullish signal from a technical perspective. This also fits in nicely with my expectation of a bullish move till July.

Color me extremely bullish on this news. Read the rest of this entry >>

Friday, May 22, 2009

A detailed look at Dow: did GM bring it down today?

The headlines were screaming: Dow closes in the red today after GM's late-day skid. Perhaps a more appropriate headline should have read: A 25% decline in GM barely budges DOW. (After all, Dow was only down 0.18% today). The massive 25% decline in GM stock contributed only about 0.04% to Dow’s decline! (or about 25% of the day’s decline). So much for the adage, "as GM goes, so goes America".

The Dow is a price weighted index, so as the price of a stock goes to zero, the impact on the index becomes increasingly insignificant. The upshot is that GM’s contribution to Dow is basically non existent. If GM were to file for bankruptcy, and GM stock goes to 0, (or $0.01 as detailed in this SEC filing), the Dow would only be down by 0.1% because of it. That’s noise basically.

Just for fun, I decided to calculate the Dow Jones index with various components removed:

As can be seen, the impact of removing General Motors(GM) and Citigroup(C) from the Dow is only 0.5%. Looks like Mr. Market has basically priced in a GM bankruptcy and Citi common equity getting diluted to oblivion. Further, Bank of America(BAC) or General Electric(GE) going to zero would only result in declines of 1.06% and 1.26% respectively. Even including all four, we're looking at a 2.8% decline. So basically all these components becoming pretty much worthless is already priced in. What's NOT priced in however, is these components going back to their earlier price highs.

Wintel's effect on Dow: Just for fun, and for the sake of illustrating the weirdness caused by using price weighted indexes, I've included the impact on the Dow of removing Intel(INTC) and Microsoft(MSFT). As can be seen from the chart, both Intel and Microsoft can go out of business, and the Dow would only suffer a 3.3% decline.

Role of financials in Dow: Let’s assume that things become great and the financials go back to their pre-crash market capitalization. Even then, because of the record high equity dilution in the financials (because of TARP injections, preferred to common conversion, raising capital in the form of equity, etc) their stock prices would remain low (unless they do a reverse split). Because Dow is price weighted, what that basically implies is that the financials would have an increasingly small role to play in Dow’s daily gyrations, even assuming they go back to their previous market capitalization highs.

Financials under performing in the next bull market is almost a certainty as far as the Dow is concerned.

The data above basically shows how concentrated the Dow index really is. For all practical purposes, Dow is a 26-27 component index today.

Thursday, May 21, 2009

Smart money on market direction: Bears caught flat footed?

With an almost ~40% equity markets rally behind us, this bull market may still have some upside left. The bears sure got caught flat footed on this one. It’s always interesting to collate responses from different strategists. I find that recurrent themes makes it easier to filter out the noise. (Consider this to be similar to the "most widely held" consensus stock portfolio. Only in this case we’re trying to divine the "most widely held" very-smart money strategy. )

I’ve written two other recent commentaries which can be found here and here. Together, they represent a nice summary of current very-smart money opinion.

Well, the consensus seems to:

- Favor gold. We already knew that several prominent funds like Paulson Funds and Greenlight Capital have recently taken huge positions in gold.

- Bearish strategists still point to the suspect technical nature of this rally, and sound as adamant as ever. Probably a little too wedded to their ideas.

- A currency crisis with dollar devaluation looks imminent

- Even the bears think the highs in this rally may be ahead of us

- 930-950 on the S&P500 represents overhead resistance. If we clear it, this bull has a lot further to go. If we don't, it's a bear market rally.

- One common thread running through a few commentaries focuses on a three cycle picture: a correction in May, another big rally into June-July, and then another really deep correction, possibly taking us to new lows (depending on how bearish the strategist is).

- Some well respected economists have chimed in on how the current rally on green shoots euphoria sounds suspect.

- Jim Rogers : The stock market may hit new lows this year or the next as the current rally has been largely caused by the money printed by central banks and fundamental problems remain unsolved

I'm not buying shares if that's what you mean. Not at all. The bottom will probably come later this year, next year, who knows when. Governments have not solved the essential problems that caused the crisis but instead they "flooded the world with money". Trying to solve the problem of too much consumption and too much debt with more consumption "defies belief" and will not work.

The next financial meltdown will be in the currency markets, as central banks around the world have been printing money, giving the appearance of massive government intervention to weaken their currencies. At the moment I have virtually no hedges, I suspect it is going to be the next problem, big crisis will be in the currency markets, I'm trying to figure out what to do there,

If I am right, you're going to see a lot of currency problems in the next decade or two. Governments around the world are doing their best to destroy currencies, many currencies in fact. And people need to understand that. If they don't understand it now.. they're going to find out, they're going to find out the hard way - Laszlo Birinyi : April took us over the brink into a new bull market. Too many stocks went down for no reason, and too many stocks have now gone up for no apparent reason. When a name like Sears which no Analyst likes goes up 50%, it tells me there’s a little bit of froth in the markets. I wouldn’t want to make a target on this market. People are still trying to get into the market. It’s a liquidity driven market. When the market slows down, we’ll find out what the economic seeds are. The ability of the market to take it in the chin and go up is really encouraging. If you go back and look in the markets in the 1930s, the first 10% correction doesn’t occur till 190 days into the market. That takes us into mid September. People won’t believe that. Cliche is that markets climb the wall of anxiety from those who missed the turn.

- Barry Ritholtz : Hard to say that a 37% gain is a sucker’s rally. That’s a good 2-3 years worth of gains under normal circumstances. In a secular bear market, any market rally should be considered a cyclical bull. It is guilty until proven innocent.

Sentiment got deeply oversold in early March. Volume’s been ok. Schwab and Ameritrade have seen volumes surging which means Mom and Pop have been speculating. It is arguable if the individual has capitulated.

Institutional investors are covering shorts and cash is coming off the sidelines (both from retail and institutions).Cash has come down from 16-17% to 8-10%. Still not like in the 90s where it was in the -16% range. Sentiment is neutral. Sentiment isn’t impacting things. With rates at zero, cash is trash. The sensation that the world is coming to an end is abating.

I’m calling it a cyclical bull market, not necessarily a sucker’s rally. The market is most likely to chop around in a wide range between Dow 7500 and 9500 the next couple of months. But if we go through 950 on the S&P we are going to see a whole bunch of cash flow in.

If we move above 950 on S&P and 9800 on Dow we can revisit if this is a cyclical or secular bull. It’s not a buy and hold environment yet. - Doug Kass : I have good news and bad news. The second derivative rally that I expected has occurred. I think the stocks are ahead of fundamentals, and I think the stock market rally is very popular now. This may not be endurable. Good news is that the generational low is intact.

Too many people who worship at the altar of price momentum in this business don’t look at value or lack of value as a catalyst. While the stock market won’t return to its March lows, a “vicious correction” is in store. It’s going to be bumpy and have a lot of potholes, so we’ll have to be cautious. I do think that stocks are ahead of fundamentals.

There’s a hole in the consumer’s balance sheet. And there’s a hole in his confidence, which is justified because of the ill-fated dependency on the asset appreciation of home prices and stock prices.

Bottom line: “The consumption binge is over,” This great debt unwind, both from a standpoint of consumer and bank balance sheets, is going to have a long and negative tail to it. - Peter Eliades of Stockmarket Cycles : It’s been a fabulous rally, no question about it. In fact if you compare it historically, this is the greatest rally in 70 years in such a short period of time. Problem is, where are we to where we were in relation to January?

We haven’t even retraced back to the highs again. From Jan to March we had this huge decline and now we’ve snapped back, come back almost all the way back to the January high.

No one talked about the greatest decline in the last 70 years but now that we’ve had this everyone wants to be optimistic about it. It could be something more than what I think it is, but I do think this is a bear market rally.

Overbought market: eg. relative strength indicator. 9-day RSI last week reached 73-74

70 is considered overbought. Most overbought reading since Oct. 2007, the all time highs. The 4000 target on the Dow is still there, the big rally has not done away with that. You want to watch this 8500 level. If we get no higher than this level, then it’s showing us that we’ve done just what the markets did back in 1930-31 in that bear market rally. So if we can get above that level, stay above that level for a few weeks, get up to 8800-900-9500 then it’s showing us that the market now is doing something different from what it did back in 1929-32. So this well might not be as bad a market, or as bad an economy. Uptil now it has told us nothing of that kind just told us to be careful because everything we’ve seen is as bad as it was back in 1929-32. - Bob Janjuah : 1 - Since Jan Kevin and I have both felt that H1 09 would be a positive surprise in terms of data and mrkts, setting the scene for a nasty H2.. Over the next 2mths or so, which overall will be a bullish time for risk (subject to '2' below), supported by less bad data, I fully expect positioning, sentiment, valuations and expectations to FULLY price in the 'V'. When folks realise that we have a multi-yr U or even, in some places, an L ahead of us, the re-price of risk, esp. equities but also credit, EM and risk currencies, will be savage. I am looking for new lows in equities late this yr, new wides in HY spreads, and moves back to the wides in IG corps & EM spreads. Deep deflation is ahead of us - it is real already in asset prices, but will become very obvious in the official 'inflation' data in H2

2 - Shorter tem, I continue to see a 10/15% correction lower in equities in May, which as I have said for some weeks now (see below) would begin near/just above 900 S&P.

3 - I THINK the mini-May sell-off is underway - albeit the real action may not be seen until next week - and as such I am happy to position NOW - on a trading basis - for a move down in S&P to 800/780. I would stop myself out if S&P rallied and closed above the 200-day MOVAVE for 4 consecutive days..

4 - Note however that the mini-May sell-off call is only a medium conviction tactical call for a pull back from overbought conditions in stks. Any May sell-off will likely only last a few weeks and will I think suck in bears just ahead of another June/July assault on the Jan highs and the 200-day MOVAVE. It is this rally leg that will have folks FULLY pricing in the V and which will consign the green shoots to the bin, to be replaced by 'the V is here, its real, and its time to get fully invested' shrill call from all those same folks who got you long and wrong into 2007.AT THIS POINT, and subject to what the data and our indicators are telling us (rather than what we WANT to believe), I will likely want to get UBER BEARISH risk assets across the board (bullet point 1 above). I maintain my view that, from current levels, we can see global stks off by 30/40% in H2 09, with a 550 S&P target. - Bob Doll : There’s a lot of skepticism about the rally, a lot of curiousness about it. Does it have legs? What does this mean for the economy? In general people remain skeptical. Which is part of why we have not seen the high in this rally. We have to get some of that money in. now we are in a short term setback that’s not over but eventually we come out to the upside before the rally ends.

- Paul Krugman : It looks to me now as if the markets are now pricing in a rapid recovery, that they’re pricing in a V-shaped recession, which I consider extremely unlikely. The market seems to be looking as if this is going to be an average recession, but it’s not.

- Niall Ferguson : Even if the world economy is not headed towards a 1930s-style catastrophe, it will remain mired in a "depression" like that experience in the 1870s. This will be a bad time for everyone, except for populists and those who like to demonstrate in the streets. The biggest winner may be China, who will supplant the U.S. as the global hegemony, as the U.S. replaced a similarly heavily-indebted Britain at the end of World War II.

- Nouriel Roubini: Rallying global stock markets will likely reverse trend later this year when weak earnings and economic news surprise investors. This is still a bear market rally

Macroeconomic news to be worse than expected: lower than expected earnings, and more bad news from the banking sector or an emerging market crisis. We will discover soon enough that there are a lot of financial shocks. While financial markets are mending, we are going to see negative surprises in the next few quarters. Markets are getting ahead of themselves. - Jeremy Grantham : If the stock market is many times more sensitive to financial stimulus in the short term than the economy is, then we could easily get a prodigious response to the greatest monetary and fiscal stimulus U.S. history. Second, if you don’t think there is a special, one-off, super colossal dose of moral hazard out there today, you are sadly uninformed. The moral hazard in play today is of a massively larger order than any we have ever seen.

My guess is that the S&P 500 is quite likely to run for a while, way beyond fair value (880 on our revised data), to the 1000-1100 level or so before the end of the year. In a rally to 1000 or so, the normal commercial bullish bias of the market will of course reassert itself, and everyone and his dog will be claiming it as the next major multi-year bull market. But such an event – a true lasting bull market – is most unlikely.

A large rally here is far more likely to prove a last hurrah … a codicil on the great bullishness we have had since the early 90s or, even in some respects, since the early 80s. The rally, if it occurs, will set us up for a long, drawn-out disappointment not only in the economy, but also in the stock markets of the developed world.

To be honest, I believe that most of you readers are likely to be grandparents before you see a new inflation-adjusted high on the S&P. - David Tice : This is a secular bear market. This is different than anything we’ve faced over the last 25 years. The excesses and imbalances of this debt overhang are so vast. We always have bear market rallies inside secular bears that suck people in. The economy’s come back a little.

I’ve never been more confident of anything in my life that that we’re headed back to 400, to book value and below book value. Excesses will be corrected by an opposite reaction. There will be another decline, another rally.. pattern would be towards a lower low.

Timing is difficult, but I believe it will be inside 6 months. The next decline is going be significant. It will be wave C in Eliott Wave terms. This could be the big one. This is the one where a lot of hope is destroyed. We could have a decline, a rally and then the big C decline. - Marc Faber : I take 2006 and early 2007 as the peak of prosperity in this long cycle, and I don’t think we’re going back there anytime soon. I think the final low in the markets will occur when the system is cleaned out.

Unless the system is cleaned out of losses, the way communism collapsed, capitalism will collapse. The best way to deal with any economic problem is to let the market work it through.

The US government for sure will go bust. That I guarantee you. Not tomorrow, but it will go bust. I think this is the beginning of a long-term bear market. And I think the government will have to keep interest rates artificially low because deficits will be too high.

I think that, at least in nominal terms (inflation-adjusted), the global printing presses being run by the world’s central banks and fiscal deficits have begun to impact asset prices positively. Stocks are unlikely to hit their lows from November and March. The lows reached by resource and mining stocks, as well as Asian equities and most emerging markets, are likely to hold for now. But very high volatility and “price fluctuations that don’t appear to make any sense” will be the new dominant characteristic of the market.

Recovery will be slow because government meddling in the markets will postpone it. The final low for markets and for growth will only come when the debt and losses have been cleaned out of the system.

On agriculture: Going against the grain may be costly. Investing in agriculture today will be like investing in oil in 2001 to 2002 when oil prices halved to US$17 per barrel. Agricultural commodities fell by half from June 2008 highs, but fundamentals remain strong.

Low stocks, declining productivity, and increased demand persist from a long term perspective and will drive prices higher. Population growth is rising until 2030 and will have produced an additional billion mouths to feed between 2000 and 2012 alone. - Richard Russell : There’s no question that the huge break in the market from late-2007 to March 2009 was primary bear market action. During the decline from Dow 14,164 to Dow 6,547, the Dow lost over half of its value in a period of just 17 months. In my book, that qualifies the decline from the 2007 high as a severe or major bear market. Going back over history, major bear markets tend to end with stocks selling at great values. Or as previous Dow Theorists put it, ‘stocks at bear market lows sell below known values’.

So question - Have we seen stocks selling at great values or below known values in this bear market?

Let’s take a look at previous bear market bottoms.

In July 1932, the Dow sold at a yield of 10.2%.

In June 1949, the S&P sold at a yield of 7.6%

In December 1974, the S&P sold at a yield of 5.1%.

In April 1980, the S&P sold at a yield of 5.7%.

In September 1982, the S&P sold at a yield of 6.3%.

And what was the yield on the S&P in March 2009 (the ‘supposed’ bear market bottom)? The yield on the S&P in March 2009 was 3.58%, hardly indicative of the bottom of a great bear market. Actually 3.58% is more what I’d expect at a market top. The current S&P dividend is now 2.45%.”

Now, I believe, we are in a primary bear market that will ultimately “clean house.” It will deleverage business, consumers, traders, nations and every other area that has been leveraged. The process will be extremely painful, as all bear markets are, and in the end it will bring stocks, assets, real estate, back to around the basic values that existed prior and just after WW II.

For a long time I have stated that anyone under the age of 75 has never seen “hard times.” I believe hard times lie ahead — they are already here for many people in the US and around the world. I’ve said that a house is a good buy when you can buy it, rent it out, and pay for all your expenses and still come up with a profit. I’ve said that stocks are a “bargain buy” when you can buy blue chips at 6 or 8 times earning and when dividends on the Dow or the S&P bring you a 5-6% return. If this is true, this bear market has a long way to go. - Meredith Whitney : Banks are overvalued and the government enabled them to have better first quarter earnings than they should. At a core basis, I would not own these stocks. Their business models are not going to come back.

This is the great government momentum trade. — the government enabled the banks to have better than expected, better than even the banks could organically deliver, first-quarter earnings. But the underlying core, earnings power of these banks is negligible. And things that I never imagined that I would see in my lifetime you’re seeing in terms of government intervention.

There's a massive retraction in consumer liquidity. Credit contraction is happening at an accelerated pace. Consumer spending is going to be less than people expect going forward.

For investors, you invest on what you know to be the rules of the game. But with the government involved, no rules apply. The changing rules create a big problem for investors going forward. The biggest danger here is having the retail investor shut out for a period of time because they don't know who to trust on market values. They just feel abused again and lied to again.

Last year you had the market impact the economy and this year you’re going to have the economy impact the markets. So however manufactured these earnings are going to be you’re still going to have unemployment come in worse than expected, you’re still going to have consumer defaults worse than expected and you’re still going to have consumers not spend money - Gary Shilling: We think that you’ve got to approach things very cautiously. With the recession running at least through next year, we anticipate earnings of $40 for the S&P 500 Index. Normally at the bottom you have a 10 or 12 multiple on that. With low interest rates, 15 is probably possible. That would put you at 600 on the S&P 500. I don’t think we’re through with this sell-off in stocks. The only place to hide is really my 25-year favorite: 30-year Treasury bonds. They’ve just been a stellar performer. I still own them, but I’m not sure I’d buy them at this point. We’re basically long the dollar, short commodities, short stocks and stay long Treasuries.”

- Teun Draaisma: We think the bear market rally will end sooner rather than later. None of our signposts of the next bull market has flashed green yet. We're not convinced the banking system has been fully fixed.

US housing busts typically last nearly about 42 months. We are just 26 months into this one. The overhang of unsold properties on the US market is still near a record 11 months. The new bull market will kick off later this year – perhaps in October – anticipating real recovery in 2010. - Albert Edwards: The new element in this slump is that GDP is contracting in "nominal" terms, not just real terms. Money incomes are flat. It is a crucial difference.

This is like drinking hemlock. The US is gradually slipping further towards outright deflation, just as Japan did. As companies retrench en masse they risk tipping the whole economy into Irving Fisher's "debt deflation trap".

If we are spared – still a big if – we can thank a handful of central bank governors and policy-makers who tore up the rule book, defied tabloid opinion, and took revolutionary action in the nick of time. - Royce Tostrams : S&P is showing a short term rising trend that is still intact. However, the market is running into the falling 200 day moving average that normally suggests limited upside potential at 935. High of last week was 930. high of January was 943. so theere’s a lot of overhead resistance in New York. S&P needs to break decisively above it’s 200 day MA. From there it gets higher for the remainder of the bull market, ultimately achieving a high of above 1000 level. With the % of stocks in NY below their 200 day MA till about 70%, the rally is running out of steam. Be aware of resistance and overhead supply in NYSE.

- Marshall Auerback : In the meantime, the markets have gone from discounting economic oblivion to anticipating a 4th quarter economic recovery (if not sooner). In our view, given the extent of leverage in the system, the ongoing refusal to lance the boil of toxic assets in the banking system, and a persistent reluctance to address the underlying causes of what got us into this mess, likely ensures years of Japanese style stagnation. Or if the economy does finally prove responsive to the monetary and fiscal gas that has been poured out, then an unpleasant inflation down the road awaits us. Neither of these scenarios is anywhere close to being reflected in the market at this time. The old adage of selling in May and going away never seemed more appropriate.

- George Soros : The downward trend in the financial crisis is easing and national economic stimulus packages are starting to work. The economic freefall has been stopped, the collapse of the financial system averted. The downward dynamic is easing.

I expect the recovery to make up for around half of the downturn we have had and then to move into stagnation. Asia will be first to find out of the crisis, but America is also currently doing that.

I don't expect the dollar to lose much value against the euro, on the contrary. - Martin Hutchinson, breakingviews.com : The 57pc fall in the Standard and Poor's 500 Index to its March low was jaw-dropping: larger than the 48pc decline of 1973-74, or the 49pc fall of 2000-02. This downward move was also faster: 17 months compared to 21 and 31 months in the previous two tumbles.

Still, there have been three worse bear markets in big economies. From 1929 to 1932, the US stock market dropped 89pc. UK shares fell 72pc in 32 months in 1972-75. Finally, Tokyo fell 48pc in only nine months in 1989-90, and 64pc over 30 months. It remains 76pc below its December 1989 high.

At least the world doesn't look like it is heading towards a mess of 1930s proportions. There has been no surge in global protectionism and no price deflation in the West. Thus the bottom is probably above 170 on the S&P 500, the equivalent of 1932's low.

Nevertheless, if history teaches lessons, they are sobering. A 70pc overall market fall is possible. That would bring the S&P 500 from the current 909 down to 470. - Robert Prechter :It's not the start of a new bull market. Our models are showing right now that it is a much bigger bear market than most people realize, something along the lines of 1929-1932. It's a very rare event.

I think the next leg down will be at least as severe if not more severe than what we just experienced. So you want to stay on the side of safety. As banks continue to accumulate losses and corporate earnings fall, the difficulties will probably last through about 2016. There will be plenty of rallies along the way.

Deflation is coming, it's going to lead to a depression. We're not at the bottom yet. I think we are going to have bouts of deflation separated by recoveries.

Dividend payouts, the ratio of share prices to earnings and dwindling cash at mutual funds mean U.S. equities may plunge as much as 80 percent. The 43 percent drop by the Standard & Poor’s 500 Index since October 2007 hasn’t taken prices to levels typical of the beginnings of bull markets. Have we fallen far enough on this to say that the bear market’s probably over? On our model, there should be more to come. - David Rosenberg: Since the rebound from the March 9th lows was again led by the four sectors that led the decline during the bear phase — financials, consumer discretionary, materials and industrials — it stands to reason that this was just another counter-trend rally. What we know about history is that the sectors that led the downturn are never the ones to emerge as leaders in the next sustainable bull market.

The fact that the best performing stocks were the ones with the lowest quality ratings and with the largest short interest says a lot about the nature of this rally as well — that its sustainability is in doubt. In other words, this was a rally built largely on short covering, pension fund rebalancing and the emergence of hope wrapped up in ‘green shoot’ data points. Technical factors ostensibly played a role too because the bounce in March came off the most oversold levels in the equity market since 1932 and the rally ended just as the S&P 500 kissed the 200-day moving average — as it has been known to do in these bear market rallies.

In the markets towards the end of the latest rally the volume weakened as the major averages advanced. Considering that cyclical bear markets typically end 4-5 months before recessions run their course, it is imperative that the downturn ends by August to justify the March lows in the S&P 500 and the other major averages. As doubts emerge over whether in fact the green shoots amount to anything more than dandelions, it now looks as though the major averages are about to embark on the fabled retesting phase towards the March lows. - Art Cashin : Bears had the ball and the bulls now appear to have stolen it back. We have to see if they can score with it though(!).We need to get through 930 which was the March 8 high and then you are looking at the early January highs at the mid 900s. Banks and other financials realize this is a window of opportunity. I don’t know how long this window will stay open though. I hope this continues but I’m not so hopeful.

I think the jury’s out now. The bulls managed in low volume, but nevertheless it was very good. I’d rather sit on the sidelines and wait and see. The volume on option expiration on Friday was lower than Thursday. That almost never happens. So there’s some strange undercurrents going on. Don’t know if it’s due to people switching into ETFs trying to play the sectors. Some of the traffic which would come to stocks here is going to ETFs so it’s lowering the volume here, at least that’s the assumption we’re making.

The spread of opinion here is enormous, and that’s what makes it difficult. There are those who think this is a new bull market, and those that believe it’ll hit new lows. - John Hussman : The bailout ensures that any incipient recovery will be cut short, because the only reason that our economy is able to absorb the present supply of government liabilities is extreme risk aversion that creates a demand for default-free instruments. If that risk aversion abates, it will quickly be replaced by higher short term interest rates, higher monetary velocity, and inflation that can be expected to be quite difficult to control.

The bottom line is that the attempt to save bank bondholders from losses – to provide monetary compensation without economic production – is not sound economic policy but is instead a grand monetary experiment that has never been tried in the developed world except in Germany circa 1921. This policy can only have one of two effects: either it will crowd out over $1 trillion of gross domestic investment that would otherwise have occurred if the appropriate losses had been wiped off, or it will result in a stunning and durable increase in the quantity of base money, which will ultimately be accompanied most probably by a near-doubling of the U.S. price level over the next decade. The growth rate of government spending is better correlated with subsequent inflation than even growth in money supply itself, particularly at 4-year intervals. Our present course is consistent with double digit inflation once any incipient recovery emerges.

As long as we have a set of economic policies aimed at running massive government deficits at the same time individuals are encouraged not to save, we will risk driving this economy into the ground for a very, very long time.

Market action was also mixed – volume continues to show fairly tepid sponsorship relative to durable market advances. Meanwhile, price action has been very favorable on the basis of breadth, but with the strongest leadership from industry groups with the least favorable balance sheets and financial stability. It is not typical for the industries that suffer worst in a bear market to be the ones that lead the subsequent bull market. That sort of “leadership by losers” however, is very characteristic of bear market rallies.

The valuation of precious metals stocks remains generally favorable, particularly relative to gold prices, but the strongest returns are typically in environments where Treasury yields are falling and the rate of inflation is flat or rising. Those pressures haven't been strong recently, so while we continue to hold precious metals shares here, the strongest returns are likely to emerge once downward pressure on the U.S. dollar picks up again.

While we've seen a good deal of fear, the stock market tends to go through a great deal of sideways action after panics like we've observed. It's likely that stocks will trade in a very wide 25-35% range for months. We have to be particularly observant as stocks approach the higher end of that range. - Helene Meisler : Keep your eyes on the Russell 2000 since it is the only index that has rallied back to the underside (or just about) of its broken channel line. A failure here would confirm my view that we’re in the midst of a correction.

- Jeff Saut : It is extremely rare for a stampede to extend for more than 30 sessions. In this case it appears the momentum peak came on April 17th with the S&P 500 at 876. Currently, the S&P 500 (SPX/882.88) resides only six points above that level.

Three months into the skein, however, the environment could change, setting up the potential for a “June Swoon.” Don’t look now, but the early May “highs” felt pretty toppy to us.

So far any downside correction, since the early March lows, has been contained to between 5% and 6.4%. That suggests any correction of more the 6.4% could imply more of a correction than any we have seen since the demonic S&P 500 low of 666. Measuring from the May 8th closing high of 929.23, a greater than 6.4% price decline yields a “failsafe point” of slightly below 870 on the SPX. If that level is violated, it would suggest a decline to at least 830 and maybe more.

Inferentially, at least to us, last week’s action set up the potential for a more enduring decline than what we seen since the March lows. - Robert Shiller : Now the normalized P/E ratio to the historical average was at a reading of 15.9 at last Wednesday’s close of 920 for the S&P 500. That’s a reading that suggests average returns for the next 10 years.

However, I still think the market is risky right now.

There seems to be no dramatic fundamental news since March other than the price increases themselves. The human tendency to react to price increases is always there waiting to generate booms and bubbles. The feedback is only an amplification mechanism for other factors that predispose people to want to get into the markets.

The stock markets’ rebound since March seems not to be built around any inspirational story, but rather the mere absence of more really bad news and the knowledge that all previous recessions have come to an end. At a time when the newspapers are filled with pictures of foreclosure sales – and even of surplus homes being demolished – it is hard to see any cause for the markets’ rebound other than this “all recessions come to an end sooner or later” story.

Indeed, the “capitalists triumphant” story is tarnished, as is our faith in international trade. So, here is the problem: there isn’t a plausible driver of a dramatic recovery.

The rationale must be to get the world economy out of its current risky situation, not to propel us into yet another speculative bubble. - Michael Kahn : Markets need volume to sustain bull runs, but unfortunately this run does not have it. In fact, trading volume on the New York Stock Exchange has been trending lower all month.

However, as the market pulled back, the only day on which volume was above its 50-day average was May 13 -- the day the S&P 500 dropped 2.7%. It was the only day we can truly say stock-market participants were fully engaged.

For me, the trendline from the March low remains broken to the downside despite the strength seen this week. Further, the momentum generated by this move is still less than that seen at the previous high-water mark of 930 set May 8.

If we transfer the NYSE's resistance level to the S&P 500, we get a zone between 930 and 941 as comparable resistance. For the Nasdaq, it would be 1773 to 1785.

The strategy now is to see what happens when each index gets to its respective resistance level. A breakthrough with volume would be a decent signal for at least a few more weeks of strength.

But again, I look at volume and momentum as nonconfirming indicators. And now with the VIX -- the Chicago Board Options Exchange Volatility Index -- garnering headlines by dropping below 30 for the first time since September, sentiment seems to be too bullish.

It is not the absolute level of the VIX that is the problem for me, but rather its accelerating trend. It is almost as if traders have written off all bad news, and the financial world is back to normal. Call it public optimism or complacency, but it does not make me confident that the stock market is preparing for another leg higher.

The market seems to be at a critical juncture this week. Can it break out or will it turn down? And whichever way it moves, will it have volume to confirm its direction? Clearly, we have to let the market tell us, but I remain highly skeptical. - Wayne Kaufman, chief market analyst at John Thomas Financial:

We’re "long overall" and believe that the market has a lot of room to go higher.

The average move on the first year of a presidential cycle takes stocks up into July so we think that this year, it’s really following that average.

There sometimes is a pause in May—we may have had that already, but we’re looking for a further upside into July. So for the 'sell in May and go away' crowd, we really think it’s more like: 'sell sometime in June or in early July'. - Manus Cranny of MF Global Spreads: We’ve all seen a frisky turn in these markets.

I am very surprised by this market. Momentum is just building, financials don’t seem to lose any steam. Sustainability is the key question. I personally think this market goes lower for the week and we will run out of steam. - Michael Santoli : Unconfirmed but intriguing sightings of normalcy and orderliness are being reported in the financial markets.

The last time before May that the Standard & Poor's 500 was at its current 882 level, in early January, first-quarter earnings forecasts were on the cusp of collapsing 20% in four weeks and 30% in eight. The last time the VIX was at this level, the S&P was above 1200. There is no linear relationship between the two, but still...

In early January, an incoming administration kicking up economic-policy dust was on its way to a few "messaging mistakes." Then, the notion of a Big Three bankruptcy was an alarming notion; now it is an observable fact.

As for calls that the widely invited 5% pullback of the past week is the start of a retest, or a break, of the S&P lows below 700, it is worth remembering that the big gin rummy game has tended to convene around S&P 850 in recent months.

That level has been crossed 30 times since the Nov. 20, 2008, lows and 10 times in the past 27 trading days. Whether those who missed most of the rally from the March panic arrive to buy stock somewhere around or not far below 850 -- should we get down there -- will be instructive. - Mervyn King: Britain’s recovery will probably be slow and protracted. Growth has just as much chance of being positive over the next 12 months as it has of being negative. Credit markets remained constricted and that banks were still reluctant to lend, a situation that needed to improve before a real recovery could occur.

Great uncertainty about the outlook persists. The economy will eventually heal, but the process may be slow.

Although the measures taken by the governments to stabilize their banking systems have been truly extraordinary in scale and scope, it is likely that the supply of credit will continue to be restricted for some while. - Dennis Gartman : This maybe the beginning of a big correction. I think we’re probably headed lower for a while. I want to believe that this is a new bull market. I want to believe that the lows that we’ve made over the past few months were indeed the lows for many years to come. But when you go up 35% in a matter of months, you’re going to get some correction.

And that started several days ago. I’ve been long basic stuff and agriculture. I’m out of the banks for this while. - Nassim Taleb : The current global crisis is “vastly worse” than the 1930s because financial systems and economies worldwide have become more interdependent. This is the most difficult period of humanity that we’re going through today because governments have no control, Navigating the world is much harder than in the 1930s.

The global economy is facing “big deflation,” though the risks of inflation are also increasing as governments print more money. Gold and copper may “rally massively” as a result. Gold, copper and other assets “that China will like” are the best investment bets as currencies including the dollar and euro face pressures. Equity investments are preferable to debt, a contributor to the current financial crisis. Deflation in an equity bubble will have smaller repercussions for the global financial system.

Debt pressurizes the system and it has to be replaced with equity. Bonds appear stable but have a lot of hidden risks. Equity is volatile, but what you see is what you get.” - Bill King: A portfolio manager asked us a great question: ‘How does an institutional money manager with a mandate to always be fully invested with no short or hedge recourse navigate these troubled waters?’

The most reasonable avenue given those parameters that we could conceive is some variation of sector rotation. Of course tactics are probably more important than strategy. Ergo, one should have a plan that entails a gradual rotation and re-weighting as the market ebbs and flows.

One of the clues that the recent rally might be ending is that the financial stocks, due to issuance and patsy exhaustion, have underperformed the S&P 500 the past week. Nasdaq and the Russell 2000 started to underperform the S&P 500 after the grandly bullish seasonal for stocks ended on April 30.” - James Montier : Even hard-bitten bears are starting to throw in the towel, suspecting that we really are on the cusp of new boom. That is a tell-tale sign.

Prolonged suckers' rallies tend to be especially vicious as they force everyone back into the market before cruelly dashing them on the rocks of despair yet again. Genuine bottoms tend to be "quiet affairs", carved slowly in a fog of investor gloom.

Another sign of fakery – apart from the implausible 'V' shape – is the "dash for trash" in this rally. The mostly heavily shorted stocks are up 70pc: the least shorted are up 21pc. Stocks with bad fundamentals in SocGen's model are up 60pc: the best are up 30pc. - Kevin Lane : The Nasdaq 100 rallied up to resistance over the last few days and then sold off hard from that level. This would be a natural spot for the rally to stall/retrace after improving by 38% from its lows. Ultimately we think the index can work above this level after a good pullback/retracement of some magnitude. That said the next level of good support on the index is the 1,284 level . This level coincides with a Fibonacci retracement level as well as support from the earlier range breakout and would be a logical downside target and support level. Ultimately, and only mentioned as a frame of reference, should we eventually work above yesterday’s resistance level the next target up would be 1,700, which would be a combination on a downtrend line and the next resistance zone. However for now we are more concerned with the present, which suggests we are in rally correction mode.

Certainly there was some conviction to the selling yesterday as down volume swamped up volume by a ratio of 27 to 1 and decliners bested advancers by a 6.2 to 1 ratio. For now the near-term trade direction is down until proven otherwise via internals improving dramatically and/or yesterday’s resistance being decidedly cleared.

Nimble traders can trade from the short side for a bit while others may want to use an index ETF to grab some temporary short exposure. Additionally, for those who have substantial paper profits, we would tighten up the stops.

Sunday, May 17, 2009

Weekend reading.

Another week, another set of headlines. This week’s bunch is a set of must read articles on the economy and markets.

Articles highlighted include the following:

- Enjoy the rally while it lasts - but expect to take a sucker punch: Time to get ready for the end of this bear market rally!!

- How stealing Chrysler threatens our markets : Chrysler bankruptcy could be game changing in how investors perceive risk. Watch out for the political risk!

- An Unprecedented Earnings Collapse: We’ve never had this kind of earnings collapse before.

- The Bear Puts On Some Weight: Great technical analysis courtesy Michael Kahn

- Deep Thoughts From Bob Janjuah: Where and how the markets will shape up for the rest of 2009.

- Technical talk: Nasdaq in correction mode: Interesting commentary on the Nasdaq.

- Treasury Bonds - Buying Opportunity? : Bullish signals on the treasury.

- Meredith Whitney : “I call this the great government momentum trade”: Meredith Whitney calls this rally one giant head fake.

- A Return to Trend Growth in 2010? : Why it won’t happen.

For insights into the next week and articles worth reading, be sure to check out http://news.fundamentalinsights.slinkset.com

Or Follow the link below:

MarketWatch: Dow 4,000 Still in the Cards.

"Peter Eliades of Stockmarket Cycles says the Dow still could retreat to 4,000. He feels that the current range at the 8,400 level is an important benchmark to watch."

Read the rest of this entry >>

Friday, May 15, 2009

Gadget love: Sony Products timeline.

Via Gizmodo.

While Sony may no longer be the name it used to be, they've surely changed the way the world works. To create revolutionary world-changing products for over 40 years is an unparalleled achievement. Here's a magnificent timeline of Sony products over the past 53 years.

You should Click this link for a full scale image.

Beautiful indeed!

Source:

Gizmodo

Sony Product Timeline Is a Glorious Gadget History Lesson

http://gizmodo.com/5245132/sony-product-timeline-is-a-glorious-gadget-history-lesson

Thursday, May 14, 2009

PIMCO’s Mohamed El-Erian on "A New Normal" : Part two.

This is a continuation of the summary of PIMCO’s secular outlook, "A New Normal". For part one, please click here.

On the international economy:

- Financial rehabilitation in the U.S. to occur in the context of low growth and eventual inflation down the road.

- The U.K. faces greater vulnerability to domestic and/or external financial instability.

- Core Europe will be limited by its historical inflation phobia and concerns for the integrity of the European Union.

- Japan’s growth will be hindered by fiscal and demographic issues.

- Emerging economies: Those with weak initial conditions will alternate between austerity and financial instability, while those with strong initial conditions will maintain their development breakout phase at a slower rate.

The new normal: A world of muted growth, in the context of a continuing shift away from G-3 and toward the systemically important emerging economies, led by China. (This shift towards domestic consumption in emerging economies becoming another global growth engine is something he advocated pretty strongly in his book "When Markets Collide")

On Risks: El-Erian states that the "balance of risk" picture is tilted to the downside.

- Will low global growth result in stagflation?

- Will the current efforts to repress real interest rates through quantitative easing succumb in a disruptive fashion to higher inflationary expectations and sovereign risk spreads?

- Will political feasibility (rather than economic desirability) dictate economic policy responses?

- The set of implicit contracts required for functional markets and societies are being subjected to major shocks. A disturbingly large number of parameters that anchor key behaviors have become variables. The longer it takes to restore normalcy, the higher the risk of recurrent financial instability.

- The management of public debt in industrial countries will be a delicate process. The average maturity of outstanding U.S. debt is at its lowest. Large unfunded entitlements (Social Security and Medicare) will start to significantly hit the budget.

- Any further erosion in the autonomy and mission of key economic institutions, including the Fed and FDIC would be terrible.

- El-Erian favors the front end of yield curves in many countries, as the authorities overstay with negative real policy rates.

- Income-generating instruments instead of pure equity premium.

- International orientation.

- Exploit periodic anomalies associated with clumsy internal and external handoffs.

- Favor credit spreads higher up in the economic and capital structure and on an international basis.

- Premiums across risk factors and markets will go up to reflect the disruption to the sanctity of contracts, the capital structure, as well as to the autonomy of key economic institutions.

- Renewed depreciation of the dollar, though the magnitude of depreciation against other currencies could be outpaced by that of real assets.

- Equity risk premium will now reflect a permanently higher threat of subordination

Further reading:

Peter Bernstein

The Shape Of The Future

http://www.investorsinsight.com/blogs/john_mauldins_outside_the_box/archive/2008/03/24/the-shape-of-the-future.aspx

Read the rest of this entry >>

PIMCO’s Mohamed El-Erian on “A New Normal”

I’ve written quite often in the past about PIMCO’s Mohamed El-Erian and Bill Gross. In particular, I had reviewed El-Erian’s book "When Markets Collide" which I highly recommended. It still remains one of the must read well-researched books of 2008.

El-Erian recently came out with an excellent write up discussing PIMCO’s 3 to 5 year secular outlook from their annual forum, titled "A New Normal". He has characterized the current situation as a "bumpy journey to a new normal" for a long time now. While both Gross and El-Erian have discussed in detail several of the factors below, this article neatly captures PIMCO’s thought process from a secular perspective.

The new normal: El-Erian calls for a prolonged pause, or a violent reversal, in certain key market concepts currently taken for granted. They call it the demise of the “great age” of private leverage, asset and credit-based entitlements, self-regulation, policy moderation, and shrinking direct government involvement. With the magnet of the Anglo-Saxon model in retreat, he says that finance will no longer be accorded a preeminent role in post-industrial economies. Moreover, the balance of risk will tilt over time towards higher sovereign risk, growing inflationary expectations and stagflation.

On context: The critical events which provided the context for this year’s forum were:

- The global system became unable to continue on its recent path due to debt exhaustion and poorly capitalized activities, yet also incapable of embarking smoothly on a different path as the ravages of de-leveraging resulted in disruptive overshoots and considerable collateral damage.

- The disorderly failure of Lehman Brothers was a “sudden stop” (a cardiac arrest) to the global economy and markets.

- The new normal: Recent events broadened the de-leveraging dynamics with longer-term consequences, a self-reinforcing mix of de-leveraging, de-globalization, and re-regulation

The public sector has become a notable price setter in certain markets. El-Erian finds it discomforting to see it own and control some modes of production, exchange and distribution that normally reside only in the hands of private enterprise. The public sector’s role as major supplier and allocator of credit is also unsettling. The socialization of losses has ignited popular anger, confusion and “a morality play” in parliaments around the world. Click here to read about the Top 10 political fat tail events due to the banking crisis.

The new normal: The public sector will overstay as a provider of goods that belong in the private sector.

On Financial sector: According to El-Erian, the central banks will find it difficult to undo smoothly some of the recent emergency steps.

The new normal: The banking system will be a shadow of its former self. The financial system will be de-levered, de-globalized, and re-regulated.

On structural changes to the economy: There exists insufficient demand buffers and fast-acting structural reforms to provide for a spontaneous and sustainable recovery in the global economy.

El-Erian predicts lower global growth on a structural basis. He cites several reasons for this:

- Obsolescence of entire economic sectors/structural change.

- Excessive regulation, taxation and nationalization reducing productivity.

- Legislation reducing factor flexibility and mobility.

- Existence of zombie institutions.

- Decaying capital stock due to subdued investment activity.

- Destruction of endogenous credit factories which fooled people into believing that the increase in leverage-based economic activities was sustainable.

According to El-Erian, other structural changes to note would include:

- How savings are mobilized and allocated, nationally and across borders.

- The shifting balance between the public and private sectors.

- The erosion of trust in basic market parameters like the sanctity of contracts and property rights, the rule of law, and the robustness of the capital structure.(I can’t believe something like this has become a factor to watch out for.)

- The new normal:

- Lower global growth.

- Higher unemployment.

- Price formation influenced by the legacy and continuation of direct government involvement.

- Burden sharing to become a feature of government's hand in economic life.

On US Inflation: Given the severity of the collapse in global demand and the resulting output gap, inflation may not be an imminent concern. Yet, supply also matters.

Unknown: Will the massive US fiscal and monetary stimulus erode confidence in the public goods that the country provides to the rest of the world – namely, the dollar as the world’s reserve currency, and deep and predictable financial markets to intermediate excess savings?

The new normal: The U.S. faces the prospect of a shift in sovereign risk and the return of higher inflationary expectations .

For the second half which summarizes El-Erian’s take on the international economy, risk factors and the investment baseline, please click here.

Tuesday, May 12, 2009

Why mortage rates aren’t going up.. yet.

Nice chart from calculated risk. The 10 year yield has shot up since March, while the mortgage rates have stayed at their historical low levels.

CR: The spread is back down near the lower end of the range - and this suggests any further increase in the ten year yield will push up mortgage rates.Hmm.. Spreads are almost back to where they were in the beginning of 2007, before the credit crisis implosion. This is an excellent sign and I wonder why it hasn't received wider coverage.

Anecdotally, I know of at least 2 first-time home buyers in San Diego who have been complaining of missing the bottom as prices have started trending up. Generally, the feeling among the crowd is that the bottom is in. Consensus seems to be that 2009 would be the year that prices bottom. Won’t be surprising to see a bout of speculative buying as pent up demand from buyers on the sideline materializes. (Just some non-scientific bullish sentiment data point of the day. )

People’s long term perception on housing hasn’t changed. It’s still an asset class which should “give them the 10% a year return” it always has. It amazes me how vocal real estate proponents tend to be, conveniently ignoring the long-run housing price trends. Most of the foreclosure sales have been to investors, who are essentially buying for the rental income. Problem is rents have been declining sharply as well. I live in La Jolla(UTC), and rents on some really nice 2-beds are down from 1650-1700 to 1400-1500. Figure in taxes, maintenance, HOA fees and the rent vs. buy decision still favors the renter(at least marginally).

The first-time home buyer tax break, record low mortgage rates, extremely negative media sentiment on housing. This could be an interesting summer to watch.

Obligatory long-term Case Shiller housing price index attached.

Sources:

Mortgage Rates and the Ten Year Treasury Yield

http://www.calculatedriskblog.com/2009/05/mortgage-rates-and-ten-year-treasury.html

Read the rest of this entry >>

Sunday, May 10, 2009

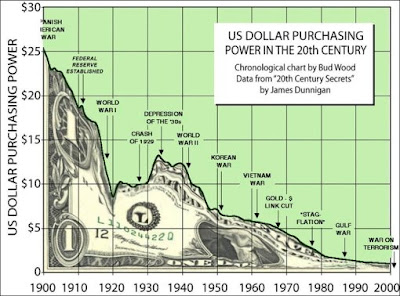

US dollar purchasing power in the 20th century.

So Zero Hedge posted this incredible chart showing that the US dollar has lost 94% of its value over the past 76 years.

Here’s another chart, this time starting from 1900 instead of 1929. The decline has been even steeper if you change the starting period to 1900.

Hmm..The dollar has declined 40% in the last 25 years(since 1985), and 80% since 1970! While the decline may seem even steeper since 1900, on an annualized basis it's a little less than if you were to start from 1933. The declines have been of the order of 3% since 1900, 3.6% since 1933, and 4.4% since 1971. So has this been the story throughout history? Apparently not, as this chart going right back to 1800 demonstrates.

These charts really put the current debate on fiat money in perspective. Blaming the current policies is easy, but the truth is that this decline has been the historical story for the past 100 years. The charts above would hold true for most of the world's currencies. According to dollardaze.org, the best performing currency in the 20th century was the Swiss Franc, losing only 80% of it's value(!). While currencies may go up and down, the long term trend for any fiat currency has been down since the beginning of the 20th century.

I would also argue that this isn’t necessarily a bad thing. The 20th century has arguably been the most prosperous century in human history. While dollar’s purchasing power has indeed declined, the average living standards today are a lot higher than they were even a few decades ago. A little bit of inflation can be a good thing.

UPDATE: This post was updated on 5/11/2009 at 10.21 pm.

Read the rest of this entry >>Fundamental Insights in the news.

Many thanks to all my readers and everyone else who takes time to come here. A snapshot of where all Fundamental Insights has been featured in the past two weeks.

- The Wall Street Journal linked to my post on free technical and fundamental analysis resources on their personal finance blog, the wallet.

- Abnormal Returns linked to my article warning that missing the early bull market could be costly.

- The Kirk Report linked to the same article above.

- The piece summarizing bull or bear market prognostications got picked up and featured on other sites, like this one on daily finance.

- The review of Pilgrimage to Warren Buffett's Omaha was linked by Value Investing News.

Sajal

Read the rest of this entry >>

Friday, May 8, 2009

Friday reading.

A quick update on links for a Friday morning which just might keep us entertained.

- Market likely to peak the end of the week

- The bottom line: Sentiment data is off of the extreme levels we saw at the lows in March; however, it has not yet reached levels that are associated with excessive bullishness.

- 'Smart money' starts to bail on stocks' rally

- Yet more evidence we're in a bear-market rally

Read the rest of this entry >>

Top 10 political fat tail events.

(HT: FT Alphaville.)

Risk consultancy Eurasia Group released a report where they discuss possible fat tail events in the political arena.

The combination of lost savings, banking crises and credit crunches, rising unemployment, growing popular discontent with financial and political elites, and the squeeze on government services is dramatically increasing the pressures on political leaders, institutions, and stability in countries all over the world.

Their top 10 fat tail scenarios are:

With the current events in Pakistan, replace military with "military or Taliban" and the probability just went up A LOT.

We live in interesting times.

Sources:

Political fat tails

FT Alphaville

http://ftalphaville.ft.com/blog/2009/04/28/55246/political-fat-tails/

Fat Tails in an Uncertain World.

eurasiagroup

http://docs.eurasiagroup.net/fattails2009.pdf

Thursday, May 7, 2009

Book Review: Pilgrimage to Warren Buffett's Omaha by Jeff Matthews

The Woodstock for Capitalists occurred over the weekend. To capture the mood, I read the book Pilgrimage to Warren Buffett's Omaha: A Hedge Fund Manager's Dispatches from Inside the Berkshire Hathaway Annual Meeting by Jeff Matthews. Living in tumultuous financial times has increased the relevance of receiving sage financial advice, and who better to turn to than the “Oracle of Omaha” himself?

The book covers the 2007 and 2008 Annual Berkshire Hathaway(BRK-A) (BRK-B) shareholder meetings. It’s basically a collection of blog posts which Jeff wrote on his website. The book is divided into two sections (for 2007 and 2008). Jeff’s perspective as an outsider rather than a “Buffetologist” is valuable as he takes a more critical look at the events and adulation surrounding the firm and the man.

Amongst the questions Jeff seeks to answer include:

Jeff notes that the meeting has changed over the years from a gathering of 250-300 investors to over 30000 last year. The focus of questions has changed from Berkshire investments to almost anything under the sun. The attitude is that of worship and adulation of Berkshire and Warren Buffett. Statistical fluke or technologic phobic, Warren Buffett has deservedly become a role model for thousands of aspiring young people. The Pilgrimage to Omaha is well worth the price.

Likes: Jeff’s criticism of Buffett and Berkshire has some merit. For instance, Buffett has been critical of CEO compensation, but was on the Board of Directors of Coke when Robert Goizueta got his $1 billion package. The book starts with a classic Charlie Munger quote: "What we have created is, to some extent, a cult." His labeling of the cohort as a cult actually hits home. It almost seems like people are flocking to see their messiah, seeking relief and the answers to their questions. He points out the lack of genuine probing business related questions. Jeff’s friend Chris actually sold his Berkshire stock after the 2007 meeting, and it just may have been the right thing to do.(Though I wonder if he’s bought it back.) Barron's had a similar opinion around that time. Interesting anecdotes like when Buffet’s kids bought their father “The Father’s Handbook” to try to get through to the old man keep the discussion personal and interesting.

Could Warren Buffet be too thrifty for his own company’s good? Jeff makes a convincing point that what’s good for Berkshire and it’s shareholders may not be good for the subsidiary companies themselves, for instance the Nebraska Furniture Mart(NFM). He points out the technological obsolescence at Nebraska Furniture Mart. While he makes a valid point, Berkshire has essentially relied on Buffett’s role as a capital allocator. It is assumed that reinvesting NFM’s earnings in other businesses would provide better returns on invested capital than in growing NFM. I thus disagree with Jeff on this, and will elaborate further on this point in a later post.

Berkshire’s investment process: Berkshire’s investment rigor can be summed as doing “lots of reading and thinking”. Their investment principle? “Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily-understandable business whose earnings are virtually certain to be materially higher five, ten and twenty years from now. Over time, you will find only a few companies that meet these standards – so when you see one, you should buy a meaningful amount of stock.”

Here’s something Buffett said in the 2007 meeting: “Corporate America is living in the best of all worlds – and history has shown this is not sustainable. I would imagine that it will not be." Little did we know that he would be right so soon. If you followed this year’s meeting, you’d remember that Munger and Buffett both had full praise for the prompt action by the administration to mitigate the current downside. This gives me optimism that we’ll come out of the Great Recession in fairly good shape, and perhaps the equity markets agree with that assertion.

Dislikes: The book doesn’t cover other events which occur over the weekend. Jeff’s perspective is that of an outsider and he doesn’t really participate in any of the festivities. His criticism on the absence of African Americans while relevant is misplaced as the class difference cannot be attributed to Berkshire. I also disagree with his assertion that Buffett’s neglect of technology stocks is a mistake. (More on this in a later blog post).

If you are looking to get value investing insights or a peek into Warren Buffet’s methodology, you’ll be disappointed. The book is a narrative of the author’s trip to Omaha, and of the Question and Answer session(Q&A) held over the weekend.

Conclusion: The book piques your interest in the proceedings and you do feel like attending the meeting! As an FYI, if you are strictly looking for a Q&A session type material, the internet has detailed meeting notes for 2007 and for 2008, and a section on quotable quotes from the 2008 meeting. Get the book to get an idea of the experience, the environment and the festivities involved in the Woodstock for Capitalists.