I’ve been thinking of doing or highlighting a thoughtful piece every Friday. So here’s a start!

Vitaliy Katsenelson recently came out with a postscript to his excellent book, Active Value Investing in Range-Bound / Sideways Markets. I’ve read parts of it, and thoroughly enjoyed it. I admire Vitaliy as one of the few people who have the uncanny ability to think “outside the fog”. (You can check out his blog to know exactly what I mean.)

Vitaliy makes some great points and I particularly wanted to highlight this one regarding the role of interest rates and inflation in determining market valuations.

Let’s take a look at the role interest rates and inflation play in market cycles… My thoughts on the role of interest rates and inflation have changed since the book came out.

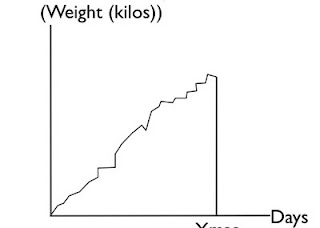

Let’s divide the interest/inflation chart into three zones: 1, 2, and 3. Zone 2 is the zone of peace. When interest rates and inflation are in this zone or thereabouts, they have little positive impact on P/Es. However, whenever inflation crosses into zone 3, investors become concerned about inflation, as they should. Inflation erodes real returns from stocks. Interest rate is a significant part of the discount rate investors use to discount future cash flows. A higher discount rate means companies are worth less, thus lower P/Es.

Zone 1 is a tricky zone. In that zone the Fed-model argument falls apart. When inflation falls below a certain level, let’s say 1%, investors become concerned that we’ll slip into deflation –a prolonged decrease in prices. Deflation brings very different risks to the table: it drives corporate revenues down while costs, which are often fixed, lag behind. Corporations start losing money; some go bankrupt. Also, unlike inflation, the Fed has few weapons to fight deflation; thus companies are for the most part on their own.

Though the discount rate used in discounted future cash flows benefits from low interest rates, the risk premium, an integral part of that equation, skyrockets. This to some degree explains why the Japanese market’s P/E collapsed while interest rates were declining. Low interest rates were a product of a very sick economy – not of strength.

Movements between these zones are very important, too. Movements towards stability(towards Zone 2 from Zones 1 and 3) are very positive for P/Es. Movements away from stability (Zone 2) are negative for P/Es.

Hmm..So are we still in a range bound market? When can we expect the next secular bull? He offers the following framework:

Good stuff!

I’ve uploaded the complete document for your perusal. (RSS/Email subscribers might have to come to the website to view the document)

Active_value_investing_range_bound_markets Read the rest of this entry >>