One of the most popular passages from the book Black Swan by Nassim Taleb has a chart illustrating the growth of a turkey. (I presume it’s popular because Taleb often talks about this). However, the image of a turkey has been much abused in relation to a Black Swan. Hence I’m going to replace the turkey instead with a giant squid reared in a fish farm.

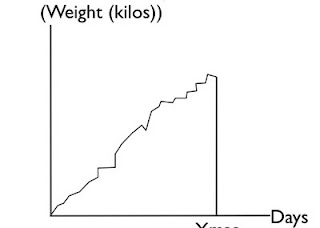

Imagine you’re the squid. Each day, you get fed more than the last day, and your weight goes up, you feel healthier and happier, and life is good. Humans are the most wonderful creatures on this planet. Such a happy state exists right until harvesting, when the fat happy squid gets butchered. A chart of squid’s growth looks something like this:

This event was entirely unpredictable to the squid right until the day it happened. This illustrates the concept of the black swan, the impact of the highly improbable.

Well I was browsing through a report called “Small lessons from a big crisis”, issued by the excellent folks from BIS.

An excerpt :

Imagine having placed a hedged bet back in 1900. A £100 long bet is placed on UK financial sector equities together with a £100 short bet on general UK equities. In effect, this is a gamble on the UK financial sector outperforming the market. How would that bet have performed over the intervening 110 or so years?

For around 85 years, this would have been a boring strategy, returning 2% per year. However, during the golden years of finance from 1986-2006, this would have risen to deliver an annual return of over 16%.

Well, the strategy’s staged a giant mean reversion since then, down almost 80% in 2008.

The similarity between the excess returns to finance and the Giant Squid are unmistakable. These were both black swan events waiting to happen.

Most of the excess gains in the financial sector were illusory in nature, an artifact of increasing leverage. The leverage juiced the sector’s equity returns, resulting in the spectacular growth shown above. Strip away the leverage, and the return on assets were miniscule.

Of course we might argue whether 2008 was a black swan, or was entirely predictable given how fragile the system had become because of the extreme leverage. (That’s a topic for another forum.)

Hopefully though, the era of excessive(and ever increasing) leverage is behind us and we are not giving birth to baby poults or squids right now for the next harvest or Christmas season.

Disclaimer: Any resemblances to real life turkeys or giant squids is entirey coincidental. No animals were harmed during the making of this article.