Purple haze all in my brain

Lately things just dont seem the same

Actin funny, but I dont know why

scuse me while I kiss the sky

Jimi Hendrix and Purple Haze might conjure up images of pot smoking beach bums, but it’s emerging markets investors whom I’m thinking of right now (especially India and China). Unless you’ve been living under some rock, you are probably aware that there has been some concern that the emerging markets might be suffering from some speculative froth. BRIC 2050 indeed! I've written about emerging markets valuations before here and here. Interestingly, similar arguments would hold true even today.

Exhibit 1: This excellent presentation on investing in emerging markets which had this interesting slide:

While they make some excellent points on emerging markets, historical returns, diversification and high GDP growth rates, I thought they missed out on one HUGE one. In any market, in any situation, the starting valuation is the most important determinant of your subsequent (ex-ante) returns. (Here are three excellent pieces by Hussman on how valuation is a solid predictor of ex-ante returns in the US markets. )

The data presented in the slide is obviously about a month or two old. Book value for India’s BSE Sensex 30 is currently 3.7 with a dividend yield of 1.2%. Price-earnings ratio for China is 35-40. Buying an index, any index, at 4 times book value or 30-40 times earnings is a recipe for disaster.

Note to Jeremy Grantham: No need to worry about blowing an emerging markets bubble. We’ve already gone ahead and done that. What’s even more astonishing is that this bubble has formed in the middle of the Great Recession. (Interestingly, GMO’s emerging markets fund is underweight India and China).

Valuations. Valuations. Valuations. That’s what investing is all about. It’s not about market timing, but market and stock pricing. Stock markets sell at 40 times earnings or 4 times book towards the END of bull markets. I realize some bubbles have ended in 60-70 P/E multiples, but irrational parabolic blow offs are very hard to time at the top – the markets could go up another 50%, but it’ll still qualify as a bubble. Bubbles tend to last longer than you can stay solvent.

Stocks in India and China are priced to deliver disappointing returns. Even if these countries grow like rock stars, much of that is already priced in. Investors banking on emerging markets for their mojo might get neutered in the process.

Friday, July 31, 2009

Emerging markets: the starting valuation issue.

Thursday, July 30, 2009

Liquidity Risk and VAR in Financial Markets

Came across this really interesting presentation on liquidity risk in the financial markets (it's dated but still good). These 3 last slides jumped out:

Interestingly, the blow up in the credit spreads was the story of 2008. Are the other two crisis waiting to happen? Yes Toto, we're not in Kansas anymore.

Read the whole thing here:

Volatility VIX

Wednesday, July 29, 2009

Mobile handset manufacturers: Operating margins.

So I came across this chart from Gigaom which shows operating margins for the handset manufacturers. I think we may be closer to a shakeout than we may realize. (Think 12 months. )

It’s quite amazing how Nokia’s margins have been punished. Remember the time when Nokia smartphones would sell for $700+, and people would lap it up? Those days are gone for good. Which is why I think Nokia will find it really hard to go back to the 50% margin days. 30% margins aren't that bad you know? RIMM is only now getting there. Nokia has one of the best brand values in the world, especially in Asia. It just might be a value buy right now.

Sony Ericsson and Motorola are both hurting bad. At least one of them will not make it through this downturn. Those margins are telling you that betting against RIMM might not be the smart thing to do.

Monday, July 27, 2009

GMO's Jeremy Grantham July Newsletter

Jeremy Grantham just came out with his latest investment newsletter. These 2 charts best quantify the speculative nature of the latest rally:

Read the full thing here:

Grantham GMO July 2009

Reading links

Another week. Another set of great reading news links. Here’s a sneak preview:

- Why Diversification Results In Mediocrity

- 7 Reasons Why Housing Isn’t Bottoming Yet

- Earnings back to 1922 (Chart).

- PIMCO says buy US Treasuries!!

- A sanity check for bulls: What is your forecast for the following a year from now?

Tax rate, including state, local, property and sales taxes (Up, down or flat)

Short term interest rates (Up, down or flat)

Employment (Up, down or flat)

Savings rate, remember the new frugality (Up, down or flat)

Consumer confidence (Up, down or flat)

Do your answers add up to a bullish outlook for the economy? I didn’t think so. - Dow Theory calls a bull market: The long-awaited Dow Theory bull market signal finally arrived yesterday. This came about as a result of the Dow Jones Industrial Average and the Dow Jones Transportation Average both breaking through their previous rally peaks (registered on 12 and 11 June respectively).

- Predicting how high S&P500 can go (Video)

- The recession isn't over... We're in the early stages of a depression! (Video)

- The Next Big Technical Pattern : This is not meant to be a short-term forecast but rather a framework for the bigger picture. As the S&P 500 trades toward its supposed neckline in the low 960s, I expect that more people will embrace another technical pattern that is really not there. A move above that level could have a similar, but opposite effect, and instead of creating a short squeeze it would create what a colleague has termed a "long squeeze."

When too many people think the same way, bad things happen. - Investor Sentiment: Investors Not Buying It : As investors are not buying into the rally, one might conclude that the rally will march onward and upward until they do, and then it will rollover. That seems likely. However, it is hard to imagine that prices will continue making gains at the pace seen over the past two weeks. I still stand by the sell signal and expected spike in prices that I wrote about two weeks ago. The recent "breakout" in prices will eventually be seen as a better time to sell rather then a new launching pad for a bull market. That's how I see it for now.

For much much more, please visit http://news.fundamentalinsights.slinkset.com/ or click the image below.

Read the rest of this entry >>

Friday, July 24, 2009

Louise Yamada on Bloomberg.

Caught this really interesting interview of Louise Yamada the other day. The interview doesn't start till about 32 minutes into the program.

If you remember her earlier interviews, the Queen of Technical Analysis has been famously bearish in her price targets and predictions. Interestingly, while she highlighted the negative divergences in the recent rally, she isn't expecting "more than a healthy 10% pullback"! So is she bullish or bearish?

You decide!

Thursday, July 23, 2009

Site and market update.

Updated the website with significant enhancements. Thanks for the feedback

and suggestions! Please do check it out and let me know how you like it! Suggestions are always welcome.

As far as the market is concerned, based on my reading:

Bearish bias for the week.

Bullish bias for 3-4 weeks after this one.

Wednesday, July 22, 2009

Will the stock markets bottom after the recession ends?

According to the market gospel, equities are supposed to bottom 6 months before the end of a recession. It is argued that since the stock market is a leading indicator, it anticipates the recovery in the economy and turns up before the economy does. People are advised to stay invested, given the difficulty in trying to time the exact bottom.

The 2001 recession is the obvious fly in the ointment. That recession ended in November 2001, but the equity markets didn’t bottom until 12-18 months later. While it’s tempting to reject it as a statistical aberration, I came across an argument which suggests otherwise, and this might just be the norm going forward.

In a nutshell, because of weak economic recoveries, the stock market bottoms will lag the NBER defined end-of-recessions. An excerpt from this excellent article titled “Debt and Deflation” better illustrates this point:

In all the recessions from 1967 to 1999, the NBER aligns its recession ending dates very well with the unified recovery in income, production, employment and sales. However, for the 2000-2001 recession the NBER call date for the recovery did not line up with these four coincident indicators. Although the recession officially ended in November 2001, employment and income had not turned higher. In fact, they did not trough until March and August 2003 recording lags of 16 and 21 months, respectively. Thus, the economy was only in a partial recovery, a situation that had huge stock market implications.

The S&P 500 Stock Price Index troughed prior to the end of all the NBER defined recessions from 1967 through 1999, in concert with the four key economic variables. However, in 2001 the S&P bottomed 15 months after the end of the NBER defined recession yet one and six months before the cyclical troughs in income and employment, respectively. In other words, stock prices anticipated the complete, not partial, recovery of these pillars of economic growth. Although all four of these indicators are still falling, the critical event for the financial markets will be when all four finally turn higher. If a complete recovery of these four variables is still far in the future, then the current gains in the stock market cannot be sustained, just as rallies were not sustained in 2001.

The recovery after the post-2001 recession was dubbed “the jobless recovery” because the uptick in the jobs data didn’t happen until 2003. US recoveries are getting longer and weaker. At some level this makes sense; as the economy became more service sector oriented it also became less cyclical then, say, a manufacturing economy like China. Add in things like just-in-time inventory management and the businesses could adjust inventories quickly to the end-user demand. (All these factors are straight from a class lecture). The Greenspan-Bernanke put further made the downturns mild in nature. The absence of normal downturns made the subsequent recovery slower and weaker.

Lakshman Achuthan had this interesting thing to say about the weak recoveries, and the implication for stocks going forward:

There are two secular trends which are problematic and should challenge stocks. Trend growth of recoveries, ever since world war II have been getting weaker and weaker. So our altitude is lower and lower. At the same time, the size of the cycle is getting bigger. Add these two things up, you get more frequent recessions and recessions bring with them new bear markets.Read the rest of this entry >>

The implication of weaker recoveries on stock markets is often overlooked and seldom discussed. It might be time to toss out the old perception of stocks bottoming before the end of recessions.

Weaker recoveries, lagging stock markets, more frequent bear markets, structurally higher unemployment and interest rates. Equities will surely get re-priced. One more nail in the stocks-for-the-long-run coffin.

Tuesday, July 21, 2009

Reading links.

As I’ve updated before, I maintain a news sidebar where I link to relevant newsworthy articles. The website is http://news.fundamentalinsights.slinkset.com/ which is updated almost on a daily basis as and when I come across interesting articles, so do check back regularly.

To whet your appetite, here’s a sampler for this week.

Plummeting demand has only moderated due to stimulus policies and zero interest rates. Neither is sustainable. There may be a minibubble in commodities, additionally inflated by Chinese hoarding. All over the world, household, corporate (and now government) balance sheets are overleveraged.

It is not scaremongering to worry that the second quarter was just a blip. Indeed, Tuesday’s worse-than-expected consumer confidence data in the US suggest optimism may now be ebbing away.

And since we are in the midst of the cyclical turning point, historic data is of very little relevance to the actual state of the economy. We reiterate our advice to use the current pause in the cyclical asset rally to add to long exposures.

And, at the same time, there are many who would argue that taking advantage of accounting-rule changes is not making money and that the "profits" are fake. If that's true, take some comfort. Even this year's alleged record bonuses will probably be paid in illiquid, long-term stock that banks can pull back any time they like. Fake bonuses, then, for fake profits.

"Valuations going forward may show their typical sensitivity to economic uncertainty, and for this reason, the change in the slope of the volatility of inflation over the last two years is troublesome. The level of inflation volatility is still low, relative to the peaks reached during prior secular bear markets. If the level of inflation volatility continues to increase, it will become more difficult to argue that the secular bear market has come to an end."

Inflationary pressures are a legitimate concern. Hester's notion that the characteristics of a true bull market bottom have not been met are intuitive and insightful. From my perspective, the Faber strategy performs more efficiently when we avoid being in the market when inflation pressures -real or perceived- are high, as determined by our inflation indicator, which assesses trends in commodities, gold, and yields on the 10 year Treasury.

This is the most compelling evidence that suggests the impending signal from the Faber strategy will be a false signal. Avoidance of equities in times of uncertainty -as measured by strong trends in gold, commodities, and yields on the 10 year Treasury bonds - is unlikely to lead to under performance.

The answer is capitalism’s dirty little secret: excessive lending was the only way to maintain the living standards of the vast bulk of the population at a time when wealth was being concentrated in the hands of an elite.

The amount by which the elite has benefited is startling, and illustrates the problem with lightly regulated free markets: the rich get much richer while the rest do not get richer at all. According to Société Générale economists, the inflation-adjusted income of the highest-paid fifth of US earners has risen by 60 per cent since 1970, while it has fallen by more than 10 per cent for the rest.

we should all come to terms with the fact that these are structural issues needing structural solutions; they need to be enforced over a longer time period than any one government’s term. So we need a new political consensus, one aimed at reducing overall debt levels while reducing inequality by encouraging education, entrepreneurship and investment in innovation.

For much much more, please click on the link below!

Monday, July 20, 2009

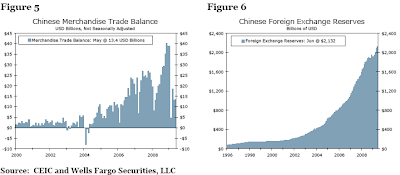

Wells Fargo on Chinese loan growth : Is China the next bubble?

On the heels of my post yesterday arguing that the equity rally we are seeing is being fed by Chinese loan growth, I came across this interesting research piece by Wells Fargo asking if China would be the next bubble? They are obviously concerned that this loan growth could lead to asset bubbles. The team actually makes a good argument that the lending boom in China is still under historical norms, especially when compared to an over leveraged US.

The report in chart form:

Read the complete report by clicking on this Scribd document link.

Thursday, July 16, 2009

Blockbuster Chinese June loan growth: FINAL stock surge ahead?

It is widely accepted that a big reason for the Chinese equity rally was the massive increase in banking loans and money supply. Thus when the Financial Times reported a blockbuster June loan growth, I wondered if this would lead to a July-August surge in the stock markets, the last one. Looks like we might be getting one.

Here are two charts showing the credit and money supply surge:

An excerpt from the FT

China’s increasingly fretful banking regulator worries that rampant credit growth “poses risks” to the financial system. The warning comes after banks advanced Rmb5,840bn ($855bn) of new loans in the first five months, almost triple the amount a year earlier. As for June’s lending, at $220bn it was a blockbuster as banks pumped up their quarterly loan numbers, just as they did in March (to $280bn).

An unknowable amount of this cash has ended up on the blackjack tables of Macao – or that other casino, the Shanghai Stock Exchange, where daily volumes are currently three times the five-year average. But even assuming that most has gone where intended, there are still many reasons to worry.

Early this year when we had a loan surge, it led to a Chinese equity markets rally, which fed on itself, propagating to the rest of the world. (The Indian elections were of course a factor in sustaining the current emerging markets bubble.) This February Bloomberg article alleged:

Chinese companies may be using record bank lending to invest in stocks, fueling a rally. As much as 660 billion yuan ($97 billion) may have been converted by

companies into term deposits or used to buy equities.

Companies are reluctant to increase production amid a slowdown in demand and some may have diverted funds meant for expansion into the stock market to chase higher returns.

Fast growth and sustainable growth are two DIFFERENT ideas. Growth for growth's sake might not lead to the desired outcome in the long term. The state mandated growth will lead to a huge misallocation of capital, depressing your return on invested capital. Don’t confuse this rally as a beginning of a new bull market. I would argue that what we are seeing is one final bull market gasp led by casino-China. Don’t misread the tea leaves. New lows are ahead of us.

Stay tuned.

Read the rest of this entry >>

Wednesday, July 15, 2009

US Federal receipts.

Interesting chart from Zero Hedge showing past and projected individual and corporate federal receipts. Looks like either the economy is going to boom, or individual taxes are going up, A LOT.

Raising taxes (or interest rates for that matter) will dampen any incipient recovery. Well, looks like we're already headed there. From WSJ: Small Business Faces Big Bite.

The House bill would place new taxes on the wealthiest people to help expand insurance coverage to the nation's 46 million uninsured people. The legislation calls for a 5.4% surtax on those with annual gross incomes exceeding $1 million.

Households with annual income between $500,000 a year and $1 million would be hit with a 1.5% surtax, and those earning between $350,000 and $500,000 would face a 1% surtax. Those rates could eventually increase to 3% and 2%, respectively, if the government doesn't achieve certain health-cost savings.

Greg Mankiw reports that once sales tax is factored in, the top earner would be facing a marginal tax rate of 55%.

Why is this important for markets? The bull market of the 1980s and 1990s coincided with tax reforms and tax cuts. Taxes, instead of being a tailwind, will actually hamper profitability and economic growth going forward. (I'm not suggesting that raising taxes is a wrong idea. I realize higher taxes is the price we have to pay for the excesses of the past few years.) Taxes are a very important determinant of market sentiment and the economy. Apart from healthcare, the cost of cap and trade is effectively a tax. Corporate taxes should be headed higher as well. (For instance, by taxing employer health insurance, removing the deduction of expenses from foreign operations, etc). This Economist article has more.

I don't think the markets have priced this in yet. Definitely not great news going forward. Read the rest of this entry >>

Tuesday, July 14, 2009

Dispatches from Mumbai : 26/11 videos

In November last year, the world stood still and watched in shock as terrorists went on a rampage in the bustling city of Mumbai in India. Came across this excellent but disturbing documentary by Channel 4/BBC on the 26/11 terrorist attacks in Mumbai. Called 'Terror in Mumbai', it basically consists of eyewitness accounts, clips from CCTV cameras, and other never seen before footage.

Video Part 1:

Part 2, Part 3, Part4 and Part 5.

Further food for thought:

The sad thing is even after all these months, it’s business as usual as far as apprehending the culprits are concerned. Pakistan just released the main suspect.

Friday, July 10, 2009

IMF: Initial Lessons of the Crisis

Took a week long hiatus from blogging. Hope everyone had a great July 4th weekend. There are a few emails in my inbox from my readers and I hopefully should get to them this weekend. (Sorry!)

Please do check out the news site of this blog which I’m constantly updating with great articles I like.

Click here to go the news page.

While the recent financial sector reforms get debated at length, IMF released a report with their initial assessment of the crisis, and lessons learned, sometime back. The 2 images below neatly summarizes their recommendations. You can read the complete report here:

Source:

http://www.imf.org/external/np/pp/eng/2009/020609.pdf

.JPG)